Navigating the multifamily market cycle: opportunities for careers and capital

27 August 2025

Just past the midway point of the year, the U.S. multifamily real estate market finds itself at a pivotal inflection point—one where dynamics between demand, construction, and investment are shifting in ways that open notable opportunities both for professionals and investors alike.

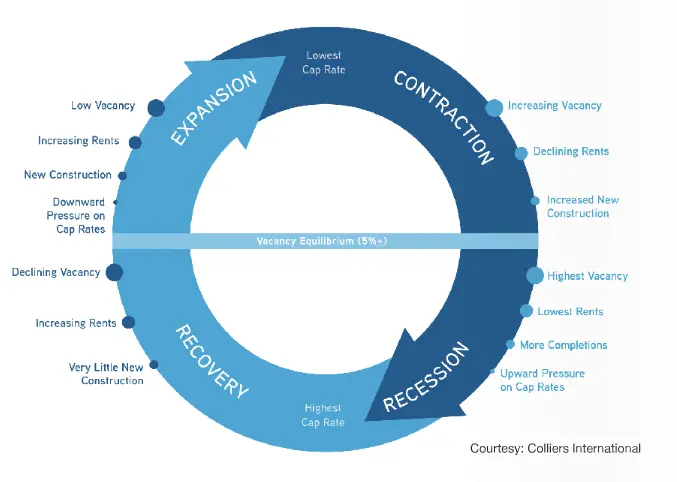

The Market Cycle: Cooling Supply, Rising Demand

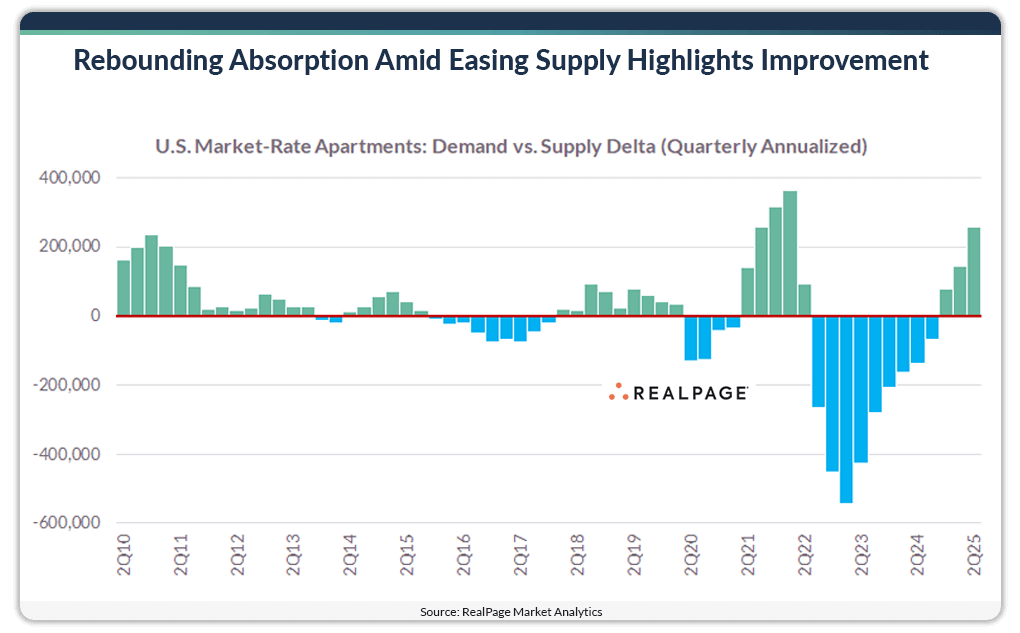

After hitting a record-high of approximately 663,000 completions in 2024, multifamily development is slowing nationally, with forecasted completions dropping to around 536,000 units in 2025 (CRE Daily). However, this July the nation saw a surprise 27.4% increase in multifamily housing starts year-over-year, underscoring strong rental demand even as homeownership remains out of reach for many (The Wall Street Journal).

Experts point to rising rents, falling vacancy rates, and high absorption as signals that the U.S. multifamily market is transitioning from oversupply to a more landlord-friendly phase. Additionally, record net absorption of around 130,000 units in Q1 2025, is driven by demographic tailwinds like Millennials and Gen Z entering peak renting age and aging Baby Boomers choosing to rent (MMCG).

Outlook Summary

- Construction is easing off its peak, letting supply stabilize.

- Renter demand remains strong, fueled by affordability pressures and demographic trends.

- Investor sentiment is improving, with fundamentals strengthening despite macroeconomic headwinds (CBRE).

There are some markets which outperform the national trends, including Chicago and Miami.

Chicago: Steady, Resilient, and Poised for Growth

Chicago is a standout for its balanced multifamily fundamentals. Construction remains low, projects underway are well below long-term averages. Meanwhile, rents are climbing. As of Q2 2025, Chicago recorded 4.4% year-over-year rent growth, with average rents at $1,922 per unit, and downtown rents reaching $3,029 (Cushman & Wakefield).

Additionally, The Chicago metro added over 100,000 residents in the last two years fueling net absorption in early 2025 which exceeded all deliveries from 2024. Over 7,300 units in six months were absorbed according to Marcus & Millichap.

South Florida & Miami: A Market Reset with Lingering Strength

After a post-pandemic rally, South Florida's multifamily market is undergoing a reset. Despite some pullback in the wider region, Miami continues to outperform other Sunbelt markets, with Q1 2025 rents up 2.2%, higher than Houston, Orlando, Charlotte, and others. Vacancy rates have also remained relatively low at 5.8% compared to the national average of 6.9%.

South Florida remains a magnet for multifamily investment due to dynamics like regional in-migration, global capital, and housing shortages which keep demand strong. While the regional cycle is cooling, long-term ROI and demographic tailwinds still shine, with Miami outperforming.

What This Means for Employees and Investors

- Career Longevity: With demand fundamentals supporting construction starts, the need for skilled construction professionals in these markets rising, particularly in resilient markets like Chicago and growth corridors in Southeast.

- Skills Matter: Specializations in value-add projects, sustainable retrofits, and different types of housing are becoming valuable differentiators.

- Regional Edge: Working in markets with stable fundamentals (Chicago) or emerging hotspots (Miami) may offer better long-term security than overheated or volatile markets. These markets have managed their supply pipeline such that careers in these regions are better insulated compared to others.

- Chicago Investors: The region offers a balanced opportunity with healthy rent growth, strong absorption, limited supply, and competitive cap rates present attractive entry points.

- South Florida & Miami: While overall pace is cooling, these regions offer longer-term upside due to population growth and housing demand.

- Macro View: Nationwide recalibration provides potential fueled by record absorption, renter demand tailwinds, and stabilizing financing suggest a favorable window for selective investment deployment.

A Balanced, Opportunity-Rich Cycle

The U.S. multifamily market in mid-to-late 2025 is shifting. Strong rental demand and favorable demographics are anchoring performance, even as headwinds like high costs and interest rates temper new development.

For employees markets such as Chicago and parts of South Florida offer both stability and dynamism. For investors, a discerning approach focused on rent growth, absorption trends, and supply constraints can yield attractive returns.

Click here to explore career opportunities with Focus in these markets, or to discuss a Focus project in one of these markets, contact us today.